Here is an article with a title that incororates the target words "crypto", "stark", and "fiat":

"Unlocking the power of crypto, delivery day stark Equity, and diversifying with Fiat Investments"

The World of Finance has undergone significant changes in recent years, driven by the rise of cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). However, For Those Looking to Diversify Their Portfolios or Invest in Emerging Markets, Other Asset Classes Offer A Compelling Alternative. In this article, We'll Explore Three Key Investment Options: Crypto, Stark, and Fiat.

Crypto Investing: The High-Risk, High-Reward Game

Cryptocurrencies Have Become Increasingly Popular over the Past Decade, with Many Investors Flocking to the Space in Search of High Returns. However, Investing in Crypto Comes with Significant Risks, Including Market Volatility, Regulatory Uncertainty, and Security Conerns. To mitigate thesis risks, it's essential to do your research and understand the underlying technology and potential for growth.

Some Notable Players in The Crypto Space Include Bitcoin (BTC), Ethereum (ETH), and Altcoins Like Cardano (Ada) and Stellar (STRK). However, Equally Among Established cryptocurrencies, Market Fluctuations can be unpredictable. That's why diversifying your portfolio with other assets is crucial.

Stark: A Unique Investment Opportunity

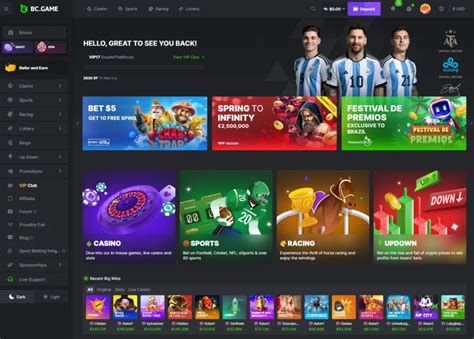

Stark is a relatively new investment platform that sacrifices a unique combination of cryptocurrency trading and investing in Fiat currencies. Stark Allows Users to Buy, Sell, And Hold Various Cryptocurrencies, Including Strk, The Native Coin of the Stark Ecosystem. This platform also Sacrifices Advanced Trading Tools, Including Leverage Options and Margin Trading.

One of the Key Benefits of Stark is its focus on scalability and usability, making it an attractive option for Investors Seeking High Returns Without the Need for Extensive Technical Expertise. Additionally, Stark Has Established Partnerships with Several Leading Financial Institutions, Providing Users with Access to a Wide Range of Investment Products.

Fiat Investing: A Diversified Approach

For Those Looking to Diversify Their Portfolios Beyond Crypto and STK, Fiat Investing Offers A More Traditional Approach. Fiat currencies like the US Dollar (USD), Euro (EUR), and yen (JPY) Are Widely Accepted as a Store of Value and Have Historically Provided Relatively Stable Returns.

Fiat Investments Can Be Achieved Through Various Means, Including Direct Purchases, ETFS, OR Index Funds. Some Popular Options Include Vanguard's Inflation-Protected Securities (IPS) ETF and Ishares Core U.S. Aggregate Bond ETF (AGG). These Products Offer A Diversified Portfolio or Bonds, Providing Exposure to a Range of Fixed-Income Assets.

Conclusion

Investing in Crypto, Stark, and Fiat Offers A Unique Combination of High Returns Potential and Diversification Benefits. While Each Asset Class Comes With Its Own Set of Risks and Rewards, Understanding the Underlying Technology, Market Dynamics, and Investment Strategies Can Help Investors Make Informed Decisions.

For Those Looking to Start Their Crypto Journey, Stark Provides an Attractive Option for Cryptocurrency Trading and Investing in Fiat Currencies. For Established Investors Seeking A More Diversified Approach, Fiat Offers A Traditional Alternative for Achieving Similar Returns. By Exploring Thesis Options and Conducting Thorough Research, Individuals Can Unlock the Power of Finance and Achieve Their Long-Term Investment Goals.

Disclaimer:

This article is for information purpos only and should not be consulted as investment advice. Always do Your Own Research and Consult with Financial Advisors Before Making Investment Decisions.