Confidential: Crypto Privacy for Withdrawing

As the world becomes more and more dependent on digital transactions, concerns about data protection and anonymity are growing. One often overlooked aspect of online banking is the use of cryptographic techniques to protect sensitive information during withdrawals. In this article, we’ll delve into the world of cryptography and explore how it can protect your financial transactions.

Problem: Weak Data Protection

Traditional online banking systems rely on passwords, usernames, and encrypted data to secure transactions. However, as more and more financial institutions move their services online, the risk of data breaches and unauthorized access is increasing. When you withdraw money online, you expose sensitive information to potential hackers and identity thieves.

Solution: Crypto Privacy

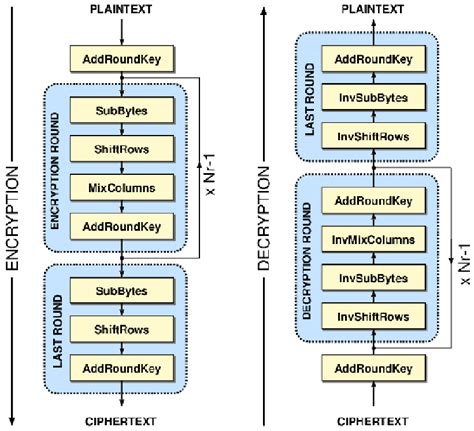

Cryptocurrencies and digital wallets have changed the way we think about secure transactions. One of the key components of these systems is cryptography — the use of mathematical algorithms to protect data from interception and eavesdropping. In the context of online banking, cryptographic techniques can be used to keep your withdrawal information private.

Key Players: Public Key Cryptography

Developed in 1978 by Ron Rivest, public key cryptography is a method for secure communication between two parties without actually exchanging sensitive information. The process works like this:

Key Exchange: Each party (you and the bank) chooses a key pair, one public key and one private key.

Encryption: When you initiate a withdrawal, your public key is used to encrypt the amount to be withdrawn. This encrypted amount is then sent to the bank’s server.

Decryption: The recipient bank’s server decrypts the message using its private key.

Secure Key Exchange Protocols

Several secure key exchange protocols are available for use in cryptographic systems, including:

Elliptic Curve Diffie-Hellman (ECDH): A widely used method for securely exchanging keys between parties.

Diffie-Hellman key exchange:

A simple and efficient key exchange protocol that is resistant to certain types of attacks.

RSA (Rivest-Shamir-Adleman) cryptosystem: A public-key encryption algorithm widely used in online banking systems.

Digital Signature Methods

Another important aspect of cryptographic privacy is digital signatures. These are mathematical algorithms that ensure the integrity and authenticity of data even if it is corrupted or intercepted.

Generating a public-private key pair: You generate a key pair, one public key and one private key.

Digital Signatures: When you initiate a withdrawal, your public key is used to sign the withdrawal amount (e.g., using a digital signature algorithm such as ECDSA).

Verification: The recipient’s bank verifies the signed message by verifying its digital signature with its private key.

Best Practices for Secure Cryptographic Withdrawals

To maximize the security of your cryptographic withdrawals:

Choose a reputable online banking service: Select a well-established institution that uses secure cryptographic methods.

Use strong passwords and two-factor authentication: Protect your account credentials with strong password management practices.

Update your software: Regularly update your devices and browsers to ensure they have the latest security patches.

Be careful when sharing sensitive information online: Do not provide withdrawal amounts or other personal details unless absolutely necessary.

Conclusion

Cryptographic privacy is essential for maintaining secure financial transactions, especially when it comes to withdrawing money.