Using Artificial Intelligence (AI) for Predictive Modeling in Crypto Economy

The world of cryptocurrency economy is evolving rapidly, and predictive modeling plays a crucial role in understanding market trends, identifying potential risks, and making informed investment decisions. With the increasing complexity of the crypto space, traditional prediction methods using financial indicators have proven inadequate. Artificial Intelligence (AI) has proven to be a powerful tool to revolutionize the field of predictive modeling in crypto economy.

Introduction

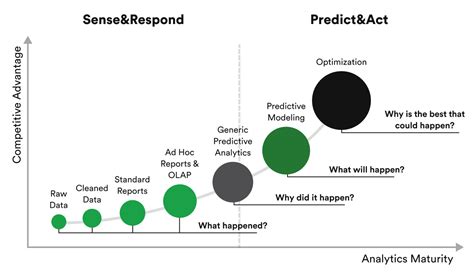

Predictive modeling is a crucial aspect of any investment strategy as it enables investors to predict market outcomes and make data-driven decisions. In the context of cryptocurrency economy, predictive modeling involves using historical data to identify patterns, trends, and correlations that can predict future market behavior. Traditional prediction methods include financial indicators such as moving averages, RSI (Relative Strength Index), and Bollinger Bands. However, these methods have limitations when it comes to capturing nonlinear relationships and complex patterns.

The Power of AI

Artificial intelligence has the potential to revolutionize predictive modeling in cryptoeconomics by leveraging machine learning algorithms that can analyze massive amounts of historical data. Machine learning enables AI systems to identify patterns, anomalies, and correlations that traditional methods may miss and provide more accurate predictions than human analysts.

There are several reasons why AI is so good at predicting market behavior:

Data Volume: Cryptocurrency markets generate massive amounts of data that can be analyzed using machine learning algorithms.

Complexity: Traditional methods struggle to capture complex patterns and relationships in nonlinear data.

Speed: Machine learning enables AI systems to analyze large data sets in real time, making them ideal for predicting market behavior.

Applications of AI in the Crypto Economy

The use of AI in predictive modeling has several applications across the crypto economy:

Market analysis: AI-powered chatbots and machine learning models can be used to analyze market sentiment, identify trends, and predict price movements.

Risk management: AI-powered risk management systems can analyze market data and identify potential risks, allowing investors to make informed decisions about portfolio diversification and hedging strategies.

Predictive trading: Machine learning algorithms can be trained using historical data to predict price movements, allowing traders to execute trades based on predicted trends.

Real-world examples of AI in the crypto economy

Several companies are already using AI-powered predictive modeling techniques to improve their investment strategies:

Quantopian: This popular cryptocurrency trading platform uses machine learning algorithms to analyze market data and predict price movements.

Binance Labs: Binance's research lab has developed several AI-powered models that can analyze market trends and predict price movements.

CryptoSlate: This crypto-focused publication uses AI-powered predictive modeling techniques to analyze market sentiment and predict price movements.

Best practices for implementing AI in the crypto economy

To maximize the potential of AI in predicting market behavior, investors should follow these best practices:

Data quality

: Make sure your data is accurate, complete, and up-to-date.

Model selection: Choose machine learning algorithms that are a good fit for your investment strategy.

Hyperparameter tuning: Regularly adjust model parameters to optimize performance.

Regular training: Continuously update and train your models to adapt to changing market conditions.