AI and KYC: Enhancing Customer Verification in Crypto

The world of cryptocurrency has seen a significant surge in adoption over the years, with millions of users worldwide. However, as with any new technology, there are concerns about security and compliance. One of the most critical aspects is customer verification, which ensures that only legitimate users can access their accounts and trade cryptocurrencies.

In recent years, traditional onboarding processes have been criticized for being cumbersome, time-consuming, and often unsuccessful. This has led to a need for innovative solutions that can streamline the process and verify customers more efficiently. Two such technologies that are gaining traction in the crypto space are Artificial Intelligence (AI) and Customer Verification (KYC).

What is KYC?

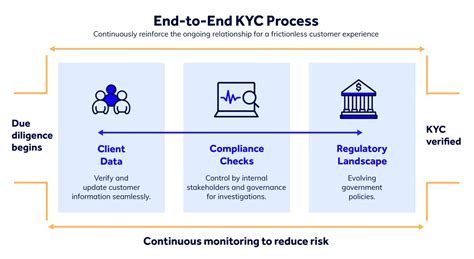

KYC stands for Know Your Customer, which refers to verifying the identity of a customer's identity. In the context of cryptocurrency, KYC is an essential process that ensures users meet certain standards before being allowed to use their accounts. This includes providing basic information such as name, address, and email.

The traditional onboarding process can be lengthy, requiring users to provide multiple documents and answer complex questions. However, this process often results in a high rate of unverified or fake accounts, which can lead to financial losses for legitimate users.

AI in KYC

Artificial Intelligence (AI) has the potential to revolutionize the KYC process by automating tasks, reducing manual effort, and increasing accuracy. AI-powered KYC systems use machine learning algorithms to analyze patterns and identify potential red flags, such as inconsistencies or suspicious behaviour.

Here are some benefits of using AI in KYC:

Speed: AI can process large volumes of data quickly and efficiently, reducing the time it takes to verify customers.

Accuracy: Machine learning algorithms can detect anomalies and errors more accurately than human reviewers.

Scalability

: AI-powered KYC systems can handle high volumes of transactions, making them ideal for large-scale crypto platforms.

Examples of AI-powered KYC Solutions

Several companies are already using AI to enhance customer verification in the crypto space:

CoinDesk's AI-powered KYC system: CoinDesk has developed an AI-powered KYC system that uses machine learning algorithms to verify users' identities and detect suspicious activity.

Binance's AI-driven KYC

: Binance, a popular cryptocurrency exchange, has implemented an AI-driven KYC process using Natural Language Processing (NLP) and computer vision techniques.

Kraken's AI-powered identity verification: Kraken, another well-known crypto exchange, uses AI to verify users' identities and detect potential scams.

Benefits for Crypto Platforms

Using AI in KYC can bring numerous benefits to crypto platforms:

Improved security: AI-powered KYC systems can detect and prevent malicious activities, reducing the risk of hacking and other cyber threats.

Increased efficiency: Automated processes reduce manual effort, allowing platforms to focus on more complex tasks, such as trading and customer support.

Enhanced compliance: AI-driven KYC systems comply with regulatory requirements, ensuring that platforms are in alignment with industry standards.

Challenges and Limitations

While AI-powered KYC solutions hold great promise, there are still challenges and limitations to consider:

Data quality: The accuracy of AI-powered KYC relies on high-quality data, which can be a challenge for crypto exchanges with complex user bases.

Regulatory compliance: New regulations are constantly being introduced, which may require platforms to adapt their KYC processes using AI.

3.